Expanding credit room – Benefits from SMEs’ perspective

Economy

109 week ago — 4 min read

Efforts of the government to allocate credit effectively

In an interview on December 8 2022, First Deputy Governor Dao Minh Tu of the State Bank of Vietnam (SBV) shared that the SBV's recent decision to increase the credit growth targets by 1.5-2% would extend more credit to the enterprises, customers and economic sectors in need.

Considering positive signs of macro indicators and the less adverse global impact on Vietnam during the final quarter of 2022, the SBV has decided to expand the credit room for the commercial banks with the vision to create more space to support the economy which are favourable conditions to the essential sector in obtaining credit. Besides, this decision aimed to effective implementation of the current policy of interest rate reduction as the liquidity of several commercial banks at that time was quite high. They have abundant credit room and have already raised the interest rates to high levels, so the SBV has found it necessary to limit their credit growth.

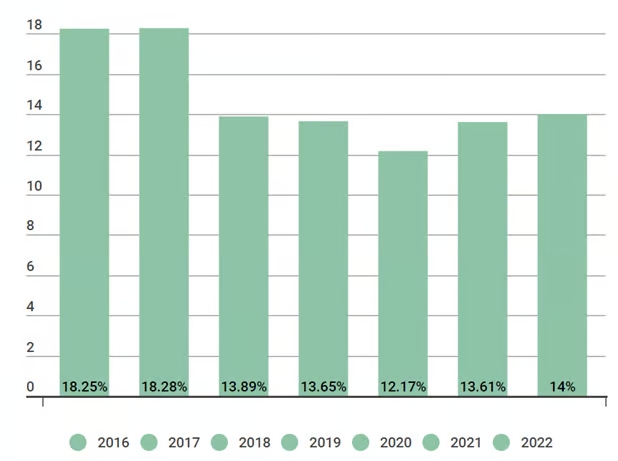

The equivalent increase to be added to the economy is VND 240 trillion. With the credit growth rate at 12.2% and the credit growth target at 14%, this increase by 1-5-2% will create up to 3.8% of credit room for the year-end period – an abundant space for the commercial banks to provide capital to the businesses and the economy Under this decision, commercial banks are requested to proactively mobilise the capital and reduce the lending interest rates, creating more lending resources and favourable conditions for the businesses, essential projects and programs in the economy.

Vietnam SMEs – Timely support for the huge demand for funding

Accounting for 98% of 800,000 active enterprises in Vietnam, SMEs seem to benefit the most from the expansion of credit room. SMEs also be recognized as one of the primary targets for this decision. In 2020, more than 32,700 SMEs have suspended or dissolved in the first two months of the year, and most of them agreed that funding is the main cause. According to the sharing from an SME in the construction field with GroBanc, in the last two years, they have been severely affected when their current bank tightened the credit room with secured loans by 20-30%. It can be seen that, besides lending application requirements, limited credit room is one of the leading reasons, making it more difficult for SMEs to access finance through banks.

Under the decision on December 5 2022, the SBV has granted the credit room and given priority to those commercial banks with high liquidity and low lending interest rates. This policy encourages commercial banks to reduce their lending interest rates. Commercial banks have been directed to prioritize credit for SMEs and direct their capital flows into these sectors. SBV will continue monitoring the activities of the commercial banks, and the cash flows using this credit room and stands ready to provide long-term capital resources for the commercial banks to have a stable source of capital to meet their essential needs.

In addition, the SBV has assigned Vietnam Banks’ Association to reach out to the commercial banks and encourage them to reduce their lending interest rates, depending on the financial capacity of each credit institution as well as the macroeconomic conditions, ensuring the liquidity, safe and sound banking operations of each CI while still supporting the businesses. All of the current policies and mechanisms issued by the SBV are expected to support SMEs' growth sustainably, and maintain macroeconomic stability.

Source: SBV Website (2022)

View Linh 's profile

Other articles written by Linh Nguyen

SMEs là gì? – Định nghĩa SME ở các quốc gia ASEAN

109 week ago

Doanh Nghiệp Huy Động Vốn Như Thế Nào?

109 week ago

Most read this week

Trending

Get Efficient at Taking Decisions

Lãnh đạo & Quản lý 26 week ago

The Art & Science of People Pleasing in Retail

Bán lẻ 29 week ago

Khởi nghiệp 29 week ago

Comments

Share this content

Please login or Register to join the discussion